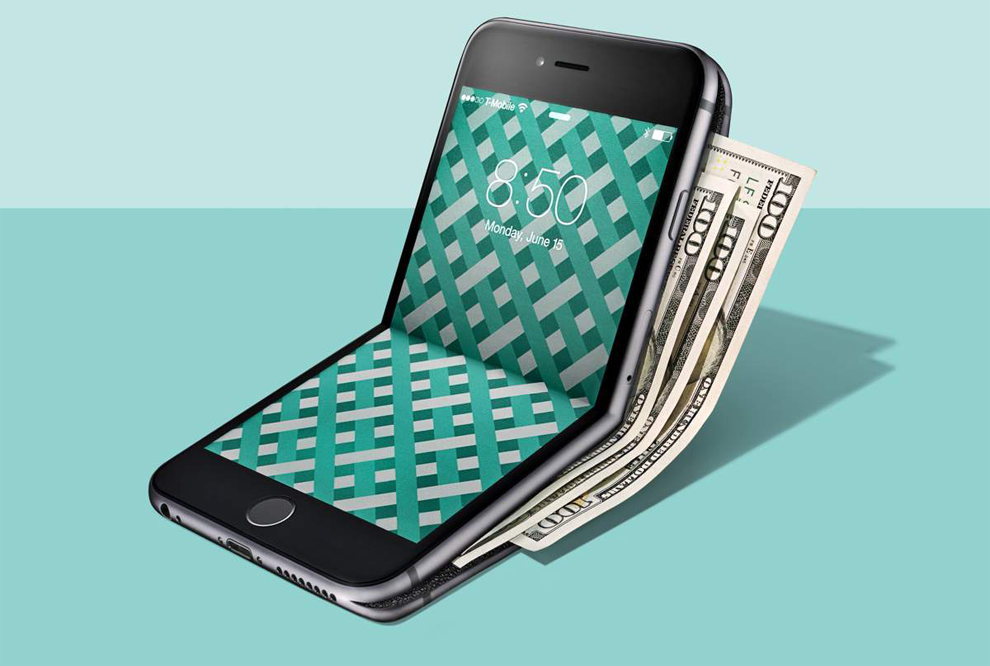

In a world increasingly defined by digital connectivity, the traditional wallet is becoming an artifact of a bygone era. For Generation Z, the cohort born roughly between the mid-1990s and the early 2010s, a wallet isn’t a leather accessory filled with cash and cards; it’s a digital application residing on their smartphones. This demographic is not just adopting digital wallets—they are driving the innovation and shaping the future of finance. They have no memory of a time before the internet, and their financial habits reflect a deep-seated preference for speed, convenience, and seamless integration with their digital lives. This article will explore the profound shift in financial behavior, delving into the core reasons behind Gen Z’s preference for digital wallets, identifying the most popular platforms, and analyzing the far-reaching impacts this trend is having on the entire financial industry.

Unlike previous generations that grew up with physical cash and credit cards, Gen Z’s financial journey began with apps. They are the first generation to come of age in a world where a transaction can be completed with a tap of a phone or the scan of a QR code. This inherent comfort with technology, combined with a demand for services that are transparent and user-friendly, has made them a powerful force in the fintech landscape. They are less loyal to traditional banks and more drawn to financial platforms that offer a superior user experience, instant gratification, and a sense of community. Their choices are a clear signal to businesses and financial institutions: adapt or risk becoming obsolete.

A. Why Gen Z is Shifting to Digital Wallets

The adoption of digital wallets by Gen Z is not a random trend but a logical outcome of their unique values and habits. Several key factors are driving this financial revolution.

A. Unmatched Convenience and Speed: For Gen Z, friction is a deal-breaker. They demand a streamlined, fast, and effortless experience. Digital wallets deliver this by eliminating the need to carry physical cards or cash. A quick tap of the phone (using near-field communication or NFC technology) or a simple QR code scan completes a transaction in seconds. This level of speed is particularly appealing for everyday purchases like coffee, public transport, or food delivery, where time is of the essence. The ability to make payments without fumbling for a card or counting out change is a significant upgrade in their daily lives.

B. Enhanced Security Measures: While older generations may view a physical wallet as more secure, Gen Z perceives digital wallets as the safer option. Digital wallets offer robust security features that physical cards cannot match. These include tokenization, where a user’s credit card number is replaced with a unique, one-time code for each transaction, making it useless to a potential hacker. They also rely on biometric authentication, such as fingerprint or facial recognition, which is far more secure than a simple PIN. The risk of losing a physical wallet, and with it, all your cash and cards, is a non-issue in the digital realm. If a phone is lost or stolen, digital wallets can be remotely wiped, protecting the user’s financial information.

C. Seamless Integration with a Digital Lifestyle: Gen Z’s life is lived online. They communicate on social media, shop on e-commerce sites, and consume media on streaming platforms. Digital wallets fit seamlessly into this ecosystem. They are integrated directly into online shopping apps and social media platforms, allowing for one-click purchases and instant payments to friends. The tedious process of manually entering credit card details for every online transaction is a relic of the past for them. This integration extends to their social lives, where splitting a restaurant bill or paying a friend back for a movie ticket is as simple as sending a text.

D. Value-Added Features and Financial Empowerment: Beyond just making payments, digital wallets provide features that empower Gen Z to manage their finances more effectively. Many apps offer real-time spending notifications, allowing users to track their budgets and expenses with a level of detail that would be impossible with cash. Features like instant peer-to-peer (P2P) payments, the ability to split bills, and integrated loyalty programs make these wallets indispensable. Furthermore, the allure of cashback rewards and instant discounts, often tied to specific merchants, provides a direct financial incentive for their use.

B. The Digital Wallets Capturing Gen Z’s Attention

The market for digital wallets is saturated, but a few key players have managed to capture the attention of Gen Z by understanding and catering to their unique needs.

A. First-Party Mobile Wallets (Apple Pay, Google Pay, Samsung Pay): These wallets have a distinct advantage due to their seamless integration with the mobile operating systems of the world’s most popular smartphones. They are often pre-installed, making them the default choice for a new phone user. Their security features, including biometric authentication and tokenization, are a major draw. For a Gen Z user, a tap-to-pay transaction with Apple Pay or Google Pay is a natural extension of their device, providing a smooth and trusted experience.

B. Third-Party Payment Apps with a Social Component (Venmo, PayPal): Apps like Venmo have achieved massive popularity by turning payments into a social experience. The ability to add emojis and comments to P2P transactions has transformed a mundane financial act into a form of social communication. Venmo’s feed, which displays anonymized transactions between friends, creates a sense of community and social connection. This social-first approach resonates deeply with Gen Z, making these apps the go-to choice for splitting bills or sending money to friends and family.

C. The Rise of Crypto and Web3 Wallets: Gen Z is more open to alternative financial systems than any previous generation. Their interest in cryptocurrency and Web3 is a key factor driving the adoption of crypto wallets like MetaMask. These wallets are not just for storing and trading digital assets; they are the gateway to the decentralized internet. They allow users to engage in DeFi (Decentralized Finance), trade NFTs (Non-Fungible Tokens), and interact with the new generation of decentralized applications (dApps). This represents a shift beyond a simple payment tool to a full-fledged financial and identity management platform.

C. The Impact on the Financial Industry and Business World

Gen Z’s wallet preferences are not just a consumer trend; they are a powerful force that is compelling banks, fintech companies, and retailers to rethink their strategies.

A. The Decline of Traditional Banking: Gen Z has a low tolerance for the bureaucratic processes and outdated technology often associated with traditional banks. They are far less likely to visit a physical branch or use paper checks. This has forced legacy financial institutions to invest heavily in their digital banking apps and customer service to stay relevant. The focus is shifting from physical branches to creating a seamless, intuitive, and feature-rich mobile experience that can compete with the nimbleness of fintech startups.

B. Increased Demand for Payment Integration: For retailers, the message is clear: support digital wallets or lose Gen Z customers. Businesses are now under pressure to accept a wide range of mobile payment options at their point of sale, both online and in-store. E-commerce platforms that offer one-click digital wallet payments often see higher conversion rates. Companies that fail to adapt their payment infrastructure to cater to this cashless generation are at a significant competitive disadvantage.

C. Driving Innovation in the Fintech Space: Gen Z’s demands have fueled an explosion of innovation within the fintech industry. Their desire for flexible payment options has led to the rise of Buy Now, Pay Later (BNPL) services like Affirm and Klarna, which allow consumers to pay for purchases in interest-free installments. Their demand for real-time insights has pushed fintech apps to integrate sophisticated budgeting tools and financial literacy resources. This is not just about payments; it’s about building a new ecosystem of financial tools that are transparent, accessible, and user-centric.

In conclusion, Gen Z’s digital wallet preferences are a clear indicator of a tectonic shift in the financial world. They have embraced a world where money is not a physical object but a fluid, digital concept. Their choices are driven by a demand for speed, security, and convenience, and they are leveraging the power of technology to take control of their financial lives. The businesses and financial institutions that recognize this profound change and adapt their models accordingly will be the ones that succeed in this new era of a cashless society.