The concept of a virtual world has captivated humanity for decades, but it was once relegated to the realm of science fiction. Today, the metaverse is no longer a futuristic fantasy; it is a burgeoning reality, and with it, a new economic frontier has emerged: metaverse real estate. This digital land, traded and developed within immersive virtual spaces, has become the focal point of a speculative boom, drawing investors, developers, and brands into a modern-day gold rush. This comprehensive article will explore the mechanics of this phenomenon, dissecting the reasons behind its explosive growth, the key players involved, the risks and rewards, and what its future holds.

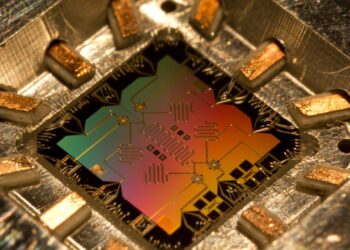

The metaverse, at its core, is a network of persistent, real-time 3D virtual worlds. It’s not a single entity but a collection of platforms like The Sandbox, Decentraland, and others, where users can interact with each other, play games, attend events, and, most importantly, own virtual assets. The land within these virtual worlds is unique, non-fungible, and owned by individuals or entities, much like physical property. What makes this possible is blockchain technology, which provides a transparent and secure record of ownership for these Non-Fungible Tokens (NFTs). Each plot of land is a unique NFT, guaranteeing its authenticity and preventing counterfeiting.

A. The Driving Forces Behind the Boom

Several factors have converged to ignite the metaverse real estate frenzy. Understanding these drivers is crucial to grasping why digital plots are selling for millions of dollars.

A. Scarcity and Exclusivity: Just like in the physical world, virtual land is a finite resource. Platforms like The Sandbox and Decentraland have a limited number of parcels available, and this inherent scarcity is a primary driver of value. The most desirable locations—those near central hubs, popular landmarks, or celebrity-owned properties—command the highest prices, creating a digital version of prime real estate.

B. The Lure of Utility: Virtual land isn’t just a static asset; it has utility. Owners can develop their land to build virtual homes, art galleries, concert venues, or even shopping centers. Brands are buying up land to host virtual stores and product launches, while artists are creating digital galleries to showcase their work. The potential for a return on investment through advertising, ticket sales, or commercial ventures is a powerful incentive.

C. Celebrity and Brand Endorsements: The involvement of high-profile celebrities and major corporations has lent an air of legitimacy and excitement to the metaverse. Snoop Dogg, for example, has built a virtual mansion in The Sandbox, which has driven up the value of surrounding land. Similarly, brands like Adidas and Gucci are establishing virtual footprints, demonstrating the commercial viability and future potential of these digital worlds. This influx of big names has acted as a powerful endorsement, attracting a new wave of investors.

D. The Specter of Speculation: At its heart, the metaverse real estate market is driven by speculation. Early investors are betting that the metaverse will one day become as ubiquitous as the internet, and that the value of their land will skyrocket as a result. While this has led to incredible gains for some, it also introduces significant risk, as the market is highly volatile and susceptible to shifts in sentiment and trends.

B. Key Players and Ecosystems

The metaverse real estate market is not a single entity but a constellation of diverse virtual platforms, each with its own unique ecosystem and economic model.

A. Decentraland (MANA): One of the pioneers in this space, Decentraland is a fully decentralized virtual world. It is owned and governed by its users, who can buy and sell land (represented by the NFT called LAND). It has a thriving ecosystem with a wide range of activities, from a virtual casino to art exhibitions. Its early adoption and decentralized nature make it a key player in the market.

B. The Sandbox (SAND): The Sandbox is a community-driven platform where creators can monetize their voxel assets and gaming experiences on the blockchain. Its emphasis on user-generated content and its partnership with numerous high-profile brands and celebrities has made it a major hub for commercial activity and virtual events.

C. Axie Infinity (AXS): While primarily a play-to-earn game, Axie Infinity also has a land component called Lunacia. Owning land in this ecosystem allows players to find rare resources and even earn passive income. Its success has demonstrated the potential for integrating real estate into a gaming-centric metaverse.

D. Other Emerging Platforms: Beyond the big names, many other platforms are vying for a share of the market. These include Somnium Space, Cryptovoxels, and many more, each offering a unique take on the metaverse and virtual land ownership. The diversity of platforms suggests that the market is still in its early stages and ripe for innovation.

C. The Risks and Rewards: A Balanced Perspective

While the potential for astronomical gains is a major draw, investing in metaverse real estate is a high-stakes game. A balanced view is essential for anyone considering a foray into this digital landscape.

A. The Rewards:

- High Potential for Appreciation: The most significant reward is the possibility of a massive return on investment. As more users and brands enter the metaverse, demand for a limited supply of land is likely to increase, driving up prices.

- Income Generation: Landowners can generate passive income by leasing their land, hosting events, or building virtual storefronts that generate revenue.

- Creative Freedom: For artists, architects, and developers, metaverse land offers a blank canvas for limitless creativity. They can build anything they can imagine, without the constraints of physical space or building codes.

B. The Risks:

- Volatility and Bubble Risk: The market is highly speculative and subject to extreme volatility. Prices can fluctuate wildly based on news, platform updates, or a general shift in investor sentiment. There is a real risk that this could be a speculative bubble, and a crash could wipe out investments.

- Platform Dependency: The value of a piece of virtual land is tied directly to the success of its host platform. If a platform loses its user base or goes out of business, the value of its land could plummet to zero.

- Uncertain Regulation: The regulatory landscape for virtual assets is still largely undefined. Governments around the world are grappling with how to regulate NFTs and virtual property, and a future crackdown could have a significant impact on the market.

D. The Future of Metaverse Real Estate

The trajectory of metaverse real estate is still being written, but a few key trends are likely to shape its future.

A. Blurring of the Physical and Virtual: As the metaverse matures, we will likely see a greater integration with the physical world. Brands may use virtual spaces to offer exclusive discounts in their physical stores, or an art gallery could host a virtual exhibition that mirrors a real-world one.

B. The Rise of Digital Urban Planning: Just as in real cities, the metaverse will need planners to manage traffic, design public spaces, and create a functional and aesthetically pleasing environment. The role of the digital architect will become increasingly important.

C. The Evolution of Virtual Commerce: The current model of virtual storefronts is just the beginning. The future will likely see more sophisticated forms of commerce, including the sale of virtual goods that have real-world counterparts, and the use of the metaverse as a platform for remote work and collaboration.

In conclusion, metaverse real estate is a new frontier that combines technology, finance, and human creativity. While it carries the inherent risks of a speculative market, it also offers a glimpse into a future where our digital and physical lives are more intertwined than ever. The digital gold rush is on, and the long-term impact of this revolutionary market will be felt for generations to come.