The digital entertainment landscape is in a state of perpetual combat, and the Streaming Wars have never been more intense. What began as a handful of pioneers offering on-demand content has exploded into a high-stakes battle for subscribers, market share, and creative dominance. Every major studio, tech giant, and media conglomerate is now vying for a piece of the streaming pie, pumping billions of dollars into content creation, marketing, and platform innovation. Understanding the key players, their strategic maneuvers, and the profound implications of this fierce competition is crucial for consumers, investors, and anyone invested in the future of entertainment.

The Genesis of the Streaming Battlefield

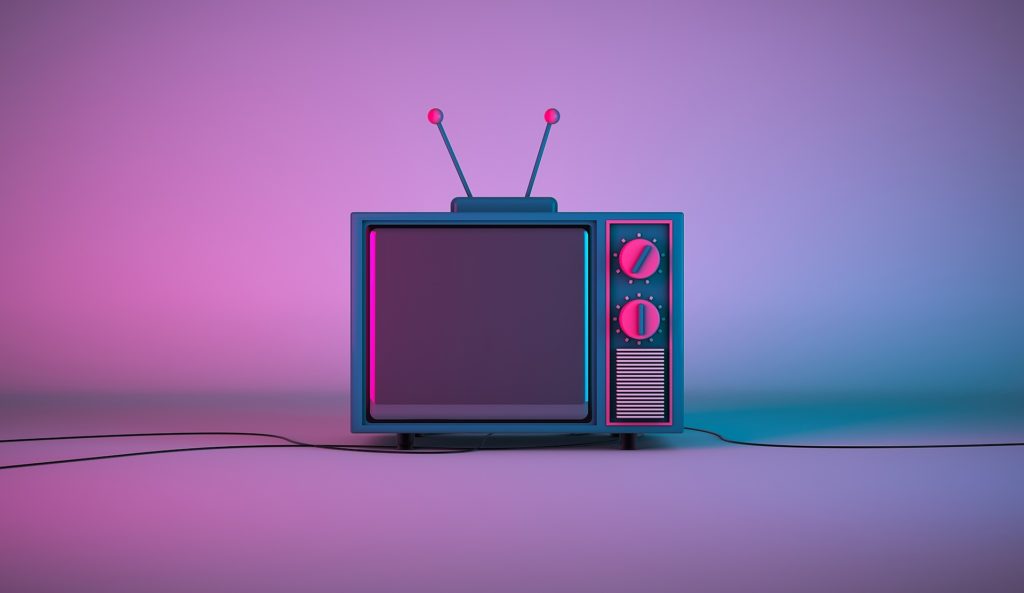

For decades, the entertainment industry was dominated by traditional television networks and cable providers. The rise of streaming challenged this long-standing model, forcing an entire industry to adapt or face obsolescence.

A. The Pioneers and the Paradigm Shift

The Streaming Wars didn’t start overnight; they began with a handful of visionary companies that saw a future beyond linear television.

- Netflix’s Early Dominance: Netflix, initially a DVD-by-mail service, was the first to truly popularize streaming. Its groundbreaking model of all-you-can-watch content for a single monthly fee revolutionized content consumption. Its early move into original content, starting with shows like House of Cards, cemented its position as a creative powerhouse and a direct competitor to traditional studios.

- Hulu’s Broadcast Backing: Hulu entered the market with a unique model, backed by major broadcast networks (NBC, Fox, ABC). It focused on offering recent TV episodes shortly after they aired, appealing to a different segment of the audience.

- Amazon Prime Video’s Bundling Strategy: Amazon’s entry was a strategic masterstroke, bundling streaming video as a perk of its popular Prime membership. This wasn’t just a content play; it was a way to deepen customer loyalty to its core e-commerce business. Its move into original, high-budget content further solidified its place.

- YouTube’s User-Generated Empire: While not a direct competitor in the premium content space initially, YouTube’s dominance in user-generated video and its massive audience size made it an undeniable force in the digital media landscape, influencing how content is created, consumed, and monetized.

B. The Entry of the Titans

The success of these pioneers convinced established media and tech giants that streaming was not a fad, but the future. Their entry turned a competitive landscape into a full-blown war.

- Disney’s Strategic Play: Disney+ launched with an immense strategic advantage: a vast library of beloved intellectual property (IP), including Disney classics, Pixar, Marvel, Star Wars, and National Geographic. It also strategically pulled its content from other platforms, forcing consumers to subscribe to access its exclusive library. This was a clear declaration of war.

- HBO Max’s Prestige Content: Backed by WarnerMedia (now Warner Bros. Discovery), HBO Max (now just Max) entered the fray with a reputation for prestige content built by HBO. Its deep library of movies and iconic TV shows, plus its commitment to high-quality new programming, made it an instant contender.

- Apple TV+’s Quality over Quantity: Apple entered the streaming market with a unique strategy, focusing on a smaller, high-budget library of original content. Its emphasis on quality, often starring A-list talent, aimed to attract a specific, discerning audience. It, too, was bundled as a perk for its massive tech ecosystem.

- Paramount+’s Broad Appeal: Paramount Global’s Paramount+ leveraged a broad content library from CBS, Showtime, Paramount Pictures, and Nickelodeon, appealing to a wide range of viewers, from families to sports fans.

- Peacock’s Hybrid Model: NBCUniversal’s Peacock launched with a hybrid model, offering a free, ad-supported tier alongside a premium subscription, attempting to capture both ad revenue and subscriber fees.

Strategies and Battlegrounds

The intensity of the Streaming Wars is defined by the diverse and aggressive strategies employed by each competitor as they fight for consumer attention and loyalty.

A. The Content Arms Race

The most visible and expensive aspect of the Streaming Wars is the relentless investment in content.

- Originals Are Key: To attract and retain subscribers, platforms must have exclusive, original content that can’t be found anywhere else. This has led to a spending spree on production budgets, with billions of dollars allocated to creating blockbuster series, original films, and documentaries.

- Leveraging Legacy IP: Platforms with deep libraries (e.g., Disney with Marvel and Star Wars, Warner Bros. Discovery with DC and HBO) are leveraging their existing intellectual property to create spin-offs, prequels, and sequels, knowing these have a built-in audience.

- Winning Over Talent: The competition for top-tier showrunners, writers, directors, and actors is fierce. Platforms are offering lucrative deals to secure exclusive talent and projects.

- Sports Rights as a Differentiator: Live sports remain a major draw for linear television, and streaming services are aggressively pursuing exclusive sports rights. Amazon’s acquisition of Thursday Night Football and Apple’s deals with MLB and MLS are prime examples, recognizing sports as a critical tool for subscriber acquisition.

- Global Expansion: Content is a global game. Platforms are not just focusing on domestic markets; they are investing in local-language content production to attract subscribers in key international markets, from Europe to Asia and Latin America.

B. Bundling, Pricing, and the Subscription Tug-of-War

The battle for a consumer’s wallet is a complex game of pricing, bundling, and perceived value.

- Pricing Power and Ad-Supported Tiers: As the market becomes saturated, consumers are feeling “subscription fatigue.” In response, many services (e.g., Netflix, Disney+, Max) have introduced cheaper, ad-supported tiers to attract price-sensitive subscribers and add a new revenue stream.

- Strategic Bundling: Platforms are bundling their services to increase value and reduce churn. Disney, Hulu, and ESPN+ are offered as a bundle, and many telecom companies bundle streaming services with their plans.

- Retention vs. Acquisition: The battle isn’t just about attracting new subscribers; it’s about retaining existing ones. Platforms are spending heavily on user experience, personalized recommendations, and a continuous flow of new content to keep subscribers from canceling.

- The “Freemium” Model: Some services, like Peacock, are using a freemium model to attract a wide base of users with a free tier, hoping to convert them to a paid subscription over time.

- Account Sharing Crackdowns: Netflix’s crackdown on password sharing is a strategic move to convert non-paying viewers into paying subscribers, a tactic that other platforms are likely to follow.

C. Technology and User Experience (UX)

Underneath the glossy content, the technology of the platform itself is a key battleground.

- User Interface (UI) and Personalization: The quality of the app, its ease of use, and its ability to provide personalized recommendations are critical for customer satisfaction. AI-powered algorithms are at the heart of this.

- Data-Driven Decisions: Streaming services collect vast amounts of data on what users watch, when they watch it, and how they interact with the platform. This data is used to inform content greenlighting, marketing strategies, and platform improvements.

- 4K, HDR, and High-Fidelity Audio: The push for higher-quality video (4K, HDR) and audio (Dolby Atmos) is a key differentiator, appealing to a premium audience with high-end home entertainment systems.

- Global Infrastructure: To support a global audience, platforms are investing billions in server infrastructure, content delivery networks (CDNs), and cloud technology to ensure low latency and high-quality streaming worldwide.

The Profound Impact for Entertainment and Culture

The Streaming Wars have implications far beyond boardroom battles; they are fundamentally reshaping the entire entertainment industry and influencing culture.

A. The New Hollywood and The Creative Renaissance

The streaming model has changed how content is made, distributed, and consumed.

- The Decline of Traditional TV: The rise of streaming is directly contributing to the decline of traditional cable and linear broadcast television. More and more consumers are “cutting the cord.”

- The New Golden Age of Television: Streaming services’ demand for exclusive, high-quality content has led to a boom in television production. The number of original scripted series has exploded, leading to what many call the “New Golden Age” of television.

- Expanded Opportunities for Filmmakers: Streaming platforms provide a home for a wider variety of content, including documentaries, foreign-language films, and niche genres that might not have a place in traditional cinema or on broadcast television.

- The Death of Theatrical Windows (for some): The push for exclusive content has sometimes led platforms to release films directly to streaming, or with very short theatrical windows, challenging the traditional cinema model.

B. Shifting Consumer Behavior and “Subscription Fatigue”

The way people watch content has changed dramatically, and consumers are feeling the pinch.

- The Binge-Watching Culture: Streaming popularized the “binge-watching” model, where an entire season of a show is released at once. This has changed how stories are told and consumed.

- Subscription Fatigue: As the number of services grows, consumers are becoming overwhelmed by the cost and the need to manage multiple subscriptions. This is driving the return of ad-supported tiers and the push for bundling.

- Search and Discovery Challenges: With so much content spread across so many platforms, finding something to watch has become a challenge, leading to a demand for better recommendation algorithms and content discovery tools.

- The Fragmented Audience: Unlike the days when a single show could capture a massive, unified audience on a broadcast network, the streaming era has fragmented the audience, with everyone watching different things on different platforms.

C. The Rise of the Super Aggregator

The complexity and cost of managing multiple subscriptions are creating a demand for a new kind of service.

- Content Aggregation Platforms: Devices and services like Roku, Apple TV, and Google TV are becoming super aggregators, bringing all the different streaming services into a single, unified interface.

- The Return of the Bundle: The intense competition is likely to lead to a new kind of content bundle, possibly offered by tech giants or telecom companies, that gives consumers a simple, cost-effective way to access multiple services.

- The Resurgence of Ad-Supported Models: As subscriptions become too expensive for many, the ad-supported model is making a major comeback, providing a lower-cost entry point and a crucial new revenue stream for platforms.

The Future of the Streaming Wars

The current state of intense competition is unlikely to last forever. The industry is on a collision course toward consolidation, new business models, and even greater technological innovation.

A. The Inevitable Consolidation

The Streaming Wars are too expensive for all but a few companies to win.

- Mergers and Acquisitions: The industry is likely to see further consolidation as smaller players are acquired by larger media conglomerates. The Warner Bros. Discovery merger is a prime example.

- The “Big Three” or “Big Four”: It’s likely that a handful of dominant players with massive content libraries and global reach will emerge, with others occupying niche positions or being absorbed.

- The End of Standalone Niches: Smaller, niche streaming services (e.g., Shudder for horror, BritBox for UK content) may survive by partnering with larger platforms or being acquired.

B. New Business Models and Revenue Streams

Beyond subscriptions and advertising, platforms are exploring new ways to monetize their content and their audiences.

- Hybrid Models are the Future: The combination of ad-supported and ad-free tiers will likely become the standard for most services, appealing to a wider range of consumers.

- Pay-per-View for Premium Events: For high-value content like new theatrical releases or live sports, platforms may experiment with a hybrid model of pay-per-view access alongside a subscription model.

- Interactive Content and Experiences: The rise of immersive technologies and platforms like the metaverse could lead to new forms of interactive storytelling and entertainment that generate revenue beyond traditional viewing.

- E-commerce Integration: Platforms may integrate e-commerce into their content, allowing viewers to purchase products seen in a show or movie directly from the streaming interface.

C. The Centrality of Technology

Technology will continue to be a key differentiator, driving innovation in content and delivery.

- AI for Content Creation: AI-powered tools could be used to assist in content production, from scriptwriting and visual effects to optimizing shooting schedules.

- Personalized Content Delivery: AI algorithms will become even more sophisticated, not just recommending content but possibly creating personalized viewing paths through a library or even generating personalized narratives.

- Immersive Technologies: Virtual and augmented reality will blur the lines between passive viewing and active participation, creating entirely new forms of interactive entertainment.

- Blockchain for Rights Management: Blockchain technology could be used to manage content rights, royalties, and fan ownership in a transparent and secure way.

Conclusion

The Streaming Wars are an intense, high-stakes battle that is fundamentally reshaping the entertainment industry and the way we consume media. Driven by a content arms race, strategic bundling, and technological innovation, this fierce competition is giving rise to a new golden age of television, a diverse array of creative voices, and a fragmented, yet highly engaged, global audience.

While the current landscape is defined by its intensity and consumer choice, the future points toward consolidation, a wider variety of revenue models, and even greater technological integration. For consumers, this means both a wealth of high-quality content and the challenge of navigating “subscription fatigue.” For the industry, it means a continuous push to innovate or be left behind. The future of entertainment is being written in real-time, and the final outcome of the streaming wars is a story that is still unfolding.